I've had this conversation with dozens of Australian law firms over the past year. They're spending anywhere from $3,000 to $30,000 monthly on marketing. When I ask what they're paying per signed client, I get blank stares.

"Our agency says we're getting leads at $150 each. We get about 40 leads a month."

That's not what I asked. What are you paying per signed client?

"Well, we probably sign... maybe 8 clients a month from those leads?"

So you're spending $6,000 to get 40 leads and signing 8 clients. That's $750 per client, not $150. And that's if all 8 clients actually came from those 40 leads, which they probably didn't because you're also getting referrals, organic search traffic, and maybe some walk-ins.

This is the problem with personal injury marketing in Australia right now. Nobody knows what they're actually paying to acquire a client because nobody's tracking it properly. And the firms that have figured it out aren't publishing the data because why would they?

Key Takeaways

The data gap:

-

No published Australian benchmarks exist for cost per client in personal injury marketing

-

US benchmarks ($2,500-$5,000 per case) don't apply to Australian market conditions

-

Most firms track cost per lead but not cost per client, hiding real acquisition costs

-

Best-case paid social campaigns show $250-$515 per client with proper tracking

-

Google Ads campaigns typically show $1,000-$3,000+ per client due to $300-$1,000 cost per lead

Why tracking fails:

-

Phone calls make attribution nearly impossible without dedicated tracking numbers

-

Sending traffic to your website instead of landing pages breaks attribution

-

Multiple touchpoints before conversion make it unclear which channel deserves credit

-

CRM systems often fail to capture accurate source data

What actually matters:

-

Cost per client alone is meaningless - a $300 client might be unprofitable while a $2,000 client could be highly profitable

-

CAC:LTV ratio (customer acquisition cost vs lifetime value) is the only metric that determines profitability

Why Google Ads Cost Per Client Is So Much Higher Than You Think

Let me show you the math that most Australian PI firms don't do.

You're running Google Ads for motor vehicle accidents in Sydney. It's competitive. Your cost per click is sitting around $80 to $120 depending on the keyword. Your landing page converts at maybe 8% if you've done a decent job with it.

Cost per lead: $1,000 to $1,500.

Not cost per client. Cost per lead.

Now let's talk about what happens to those leads. They come into your intake. Some of them are complete rubbish - wrong jurisdiction, statute of limitations expired, no clear liability, injury too minor to justify a claim. Let's say 40% of your leads actually meet your case criteria. That's being generous based on what I've seen.

So from 100 leads at $1,000 each ($100,000 spend), you get 40 quotable leads.

Your intake team needs to convert those quotable leads into signed clients. If you've got a good intake system, maybe you're converting 30% of qualified leads. That would be solid performance.

40 quotable leads at 30% conversion = 12 signed clients.

$100,000 spend ÷ 12 clients = $8,333 per client.

That's the real cost per client for Google Ads in a competitive Australian metro market.

Now compare that to the paid social campaigns I showed earlier where firms are getting clients for $250-$515. Google Ads is costing 16x to 33x more per client.

Does that make Google Ads a bad channel?

Not even close.

Here's what most firms miss: those Google Ads clients might be worth $60,000 each in fees while the social clients are worth $8,000 each. You're spending more to acquire them, but you're making far more profit per client.

This is where the entire industry gets marketing ROI wrong. They optimise for lowest cost per client when they should be optimising for highest profit per dollar spent on marketing.

Pro Tip: A $80-$120 cost per click might look scary, but your true cost per signed client is what matters. Google Ads clients often generate 5-10x more in fees than social media clients.

Quick Win

Immediately review your Google Ads landing page conversion rate. Even a small improvement drastically reduces your cost per lead.

The Only Number That Actually Tells You If Marketing Is Working

Cost per client is a vanity metric. It makes you feel good when it's low and bad when it's high, but it tells you nothing about whether your marketing is actually profitable.

The metric that matters is CAC:LTV ratio. Customer acquisition cost versus lifetime value.

For personal injury firms, lifetime value is really average case value minus operating costs. Most PI clients are one-and-done - they're not coming back for repeat business. So LTV is the profit you make on that single case.

CAC is what you spent on marketing to acquire that client.

The ratio tells you: for every dollar I spend acquiring a client, how many dollars in profit am I making?

Let me show you two scenarios that look completely different when you only look at cost per client, but tell a very different story when you look at CAC:LTV.

Scenario 1: Paid social campaign

You're running Facebook and Instagram ads targeting slip and fall, public liability type cases. Cost per client: $300. Looks fantastic.

Average case value for these types of claims: $12,000. Your operating costs (time, disbursements, overheads): $8,000 per case. Net profit per case: $4,000.

CAC:LTV ratio = $300:$4,000 = 13.3:1

For every dollar you spend on acquisition, you make $13.30 in profit. That's excellent.

Scenario 2: Google Ads campaign

You're running Google Ads for motor vehicle accidents and workplace injuries. Cost per client: $1,500. Looks expensive compared to scenario 1.

Average case value for these claims: $50,000. Operating costs: $25,000 per case. Net profit per case: $25,000.

CAC:LTV ratio = $1,500:$25,000 = 16.6:1

For every dollar you spend on acquisition, you make $16.60 in profit.

Scenario 2 costs 5x more per client but is actually MORE profitable per dollar spent on marketing.

Most firms would look at those two campaigns, see $300 vs $1,500 cost per client, and kill the Google Ads campaign. They'd be killing their most profitable marketing channel while scaling up a less profitable one.

Pro Tip: Stop measuring cost per client in isolation. A 5:1 to 10:1 CAC:LTV ratio is healthy - meaning you make $5-$10 in profit for every $1 spent on acquisition.

Key Insight

Focus on the CAC:LTV ratio, not just cost per client, to truly understand your marketing profitability.

What Personal Injury Lead Generation Actually Costs in Australia

This happens all the time. I've seen firms shut down Google Ads because " cost per lead was too high" while doubling down on social advertising that was delivering lower-value cases. Their cost per client went down. Their total profit went down more.

Here's what we've been seeing across our personal injury law firm clients over the last 120 days running Meta ads:

!Category Benchmarks - Last 120 Days Meta Ads Performance

The data shows an average cost per lead (CPL) of $30-$61, with cost per signed client ranging from $352 to $837. Leads per client vary significantly (80-297), and deals won range from 7-25 per firm. This is real Australian data from active campaigns.

Now let me show you some specific campaign breakdowns:

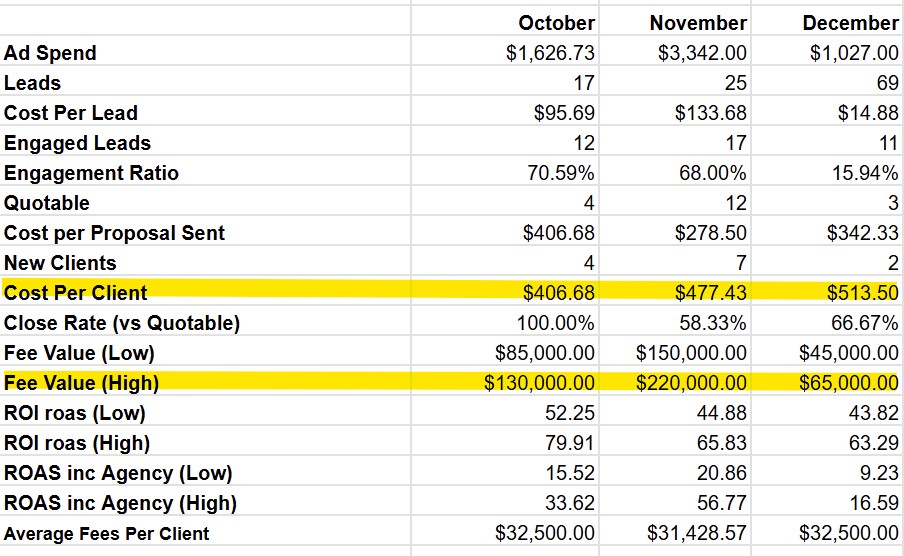

Firm 1: Paid social campaign (October-December)

| Month | Spend | Leads | Engaged | Signed Clients | Cost per Client |

|---|---|---|---|---|---|

| October | $1,626 | 17 | 12 | 4 | $406.68 |

| November | $3,342 | 25 | 17 | 7 | $477.43 |

| December | $1,027 | 15 | 5 | 2 | $513.50 |

| Average | $465.87 |

Firm 2: Paid social campaign (November-December)

| Month | Spend | Leads | Quotable | Signed Clients | Cost per Client |

|---|---|---|---|---|---|

| November | $3,163 | 148 | 21 | 11 | $287.60 |

| December | $1,653 | 92 | 11 | 6 | $275.55 |

| Average | $281.58 |

Both campaigns are running paid social advertising with form-based conversions and dedicated landing pages. That's the cleanest possible tracking scenario - you can connect ad click to form submission to signed client with reasonable accuracy.

These are best-case scenarios, not typical market results. They represent what's possible when you've got proper tracking infrastructure in place, good creative, tight targeting, and strong intake conversion.

But here's what this data doesn't tell you: are these clients actually profitable? A $281 cost per client is meaningless if those cases are worth $3,000 each and your operating costs are $2,500. You'd be making $500 profit per case with a CAC:LTV ratio of 1.7:1, which is barely break-even.

Meanwhile, a firm spending $2,000 per client on Google Ads might be printing money if those cases are worth $80,000 each with $40,000 in operating costs. That's $40,000 profit per case with a CAC:LTV ratio of 20:1.

The cost per client number by itself tells you nothing. You need to know case values.

Pro Tip: These $250-$515 per client figures are only achievable with dedicated landing pages, form-based conversions, and proper tracking. Most firms can't measure this accurately.

Pro Tip

Don't prematurely abandon high-cost-per-lead channels; they might deliver higher-value cases and better overall profit.

Why US Benchmarks Don't Apply to Australian Personal Injury Marketing

Every article about personal injury marketing costs quotes the same US numbers: $2,500 to $5,000 per signed case. Those numbers come from a completely different market structure.

The US personal injury industry operates with jury verdicts that can run into the millions. A single catastrophic injury case might settle for $10 million. Contingency fees on those cases can be 30-40% of recovery. The economics support spending $10,000 to acquire a client when that client might be worth $3 million in fees.

Competition in US metros is insane. Los Angeles has dozens of personal injury firms spending $500,000+ monthly just on Google Ads. That level of competition drives costs through the roof. A single click on "car accident lawyer Los Angeles" can cost $400-$600.

Australian personal injury operates under different rules. Compensation is more standardised. Case values are generally lower but more predictable. You don't have the same level of mega-verdicts that drive US economics.

And competition density is lower even in major metros. Sydney and Melbourne are competitive, sure, but nothing like LA or New York. You're not fighting against 50 firms each spending half a million monthly on Google Ads alone.

This creates fundamentally different cost dynamics. A US firm might need to spend $5,000 to acquire a client in a saturated market. An Australian firm in the same practice area might spend $800 to $1,500 using Google Ads or $300 to $500 using paid social.

The mistake Australian firms make is looking at US benchmarks and thinking either "that's too expensive, marketing doesn't work" or "we should be spending that much to be competitive." Neither conclusion is correct. The US numbers just don't apply here.

Pro Tip: US firms spend $5,000+ per client because mega-verdicts can yield millions in fees. Australian market dynamics are fundamentally different - stop benchmarking against irrelevant data.

Fast Fix

Stop using US marketing benchmarks. Research Australian-specific data for realistic expectations and strategy.

Why Most Australian PI Firms Don't Know Their Real Cost Per Client

I ask this question in every discovery call: what's your cost per client?

Nine times out of ten, I get some version of "we're not sure" or "our agency says we're getting leads at X dollars each."

That's not the same thing. Cost per lead tells you what you're paying for an enquiry. Cost per client tells you what you're paying for a signed retainer. The gap between those two numbers is often enormous.

Here's why most firms can't measure it accurately.

Tracking breaks at the phone call

Someone sees your ad. Instead of filling out a form, they call the number. Now you need call tracking with unique phone numbers for each advertising source to know which ad drove that call.

But even with call tracking, attribution gets messy. They might see your ad today, Google your firm name tomorrow, find your main number on your website, and call that. The call tracking number you set up for the original ad doesn't capture that conversion. Your ad drove the awareness that led to the conversion, but the attribution system credits organic search.

Most firms just use their main phone number for everything. Attribution becomes impossible.

Tracking breaks when you send traffic to your website

You run an ad. It goes to your website homepage or your personal injury practice area page. They click around, read some content, maybe bookmark the site. Three days later they come back directly and fill out a form.

Which source gets credit? The original ad? Direct traffic? Your CRM probably attributes it to direct traffic because that was the last touchpoint before conversion.

Landing pages solve this. Ad click → dedicated landing page → convert on that page. Clean attribution. But most firms send traffic to their existing website because building landing pages requires work and most agencies don't want to do it.

Tracking breaks in your CRM

Your intake team takes a call. They enter the lead into your CRM. There's a dropdown for "source" - Referral, Google Ads, Facebook, Website, Other.

The intake person asks "how did you hear about us?" The caller says "I found you online." The intake person selects "Website" because that's close enough.

But "found you online" could mean they clicked a Google Ad, saw you on Facebook, searched your firm name organically after seeing outdoor advertising, or any combination of those things. Your CRM now has bad source data.

Even if you've got proper integrations between your advertising platforms and CRM, they break. Tags don't fire correctly. Cookies get deleted. iOS privacy features block tracking. Integration stops working and nobody notices for three weeks.

All of this adds up to most firms having vague directional data at best and completely wrong data at worst.

The campaigns showing clean $250-$515 cost per client numbers are using paid advertising with form conversions and dedicated landing pages. That's the one scenario where tracking actually works reliably. It's not how most firms operate.

Pro Tip: If you're not using dedicated landing pages with form conversions, your cost per client data is almost certainly wrong. Phone calls, website traffic, and manual CRM entry all break attribution.

Key Insight

Distinguish between cost per lead and cost per client. The latter is your true measure of acquisition efficiency.

How to Calculate What You Can Afford to Pay Per Client

Stop trying to benchmark against other firms or hit some arbitrary cost per client target. Start with your unit economics and work backwards.

Here's the framework.

Step 1: Know your average case value by case type

Not your average case value overall. Your average by case type. Motor vehicle accidents might average $45,000 in fees. Workplace injuries might average $28,000. Public liability might average $10,000. You need to know these numbers.

If you don't track this data, start now. Go back through your closed cases for the last 12 months and segment by case type. Calculate average value for each category.

Step 2: Know your operating costs per case

How much does it cost you to work a case from signing to resolution? Include time costs (your hourly rate or your lawyers' salaries), disbursements (medical reports, expert witnesses, court fees), and allocated overhead.

This number is harder to calculate but critical. If you don't know your cost to deliver, you can't know your profit margin.

Let's say your operating cost is $15,000 for a motor vehicle case that averages $45,000 in fees. Your profit per case is $30,000.

Step 3: Decide your target CAC:LTV ratio

A healthy ratio is 5:1 to 10:1. You want to make $5 to $10 in profit for every dollar spent on client acquisition.

Let's use 5:1 as the target for that motor vehicle example. Profit per case is $30,000. At 5:1 ratio, you can spend up to $6,000 per client and still hit your profitability target.

That's your acceptable cost per client for motor vehicle cases.

Now do the same calculation for workplace injuries. If those average $28,000 in fees with $12,000 in operating costs, profit is $16,000. At 5:1 ratio, you can afford $3,200 per client.

And for public liability at $10,000 fees with $7,000 operating costs, profit is $3,000. At 5:1 ratio, you can afford $600 per client.

Step 4: Segment your marketing by case type

This is where most firms fall apart. They run one generic "personal injury lawyer" campaign. It attracts all case types. They can't tell which cases came from which campaign. They can't optimise because they don't know what's actually profitable.

If you segment campaigns by case type - separate campaigns for motor vehicle, workplace injury, public liability - you can track cost per client by category. Now you know motor vehicle is costing $1,800 per client (profitable at $6,000 target) while public liability is costing $900 per client (not profitable at $600 target).

Kill the public liability campaigns or fix them. Scale the motor vehicle campaigns. Your overall cost per client might go up, but your profitability goes up more because you're acquiring more high-value clients and fewer low-value ones.

Step 5: Accept that your data will be imperfect

Unless you're running closed-system paid advertising with form conversions and dedicated landing pages, your attribution will be directional at best.

That's fine. You don't need perfect data to make good decisions. You need data that's accurate enough to tell you whether a channel is roughly profitable or roughly unprofitable.

If Google Ads is showing $2,000 cost per client for motor vehicle cases and your acceptable cost is $6,000, you know you've got room to scale even if the real number is $2,500 or $3,000 due to attribution issues.

If paid social is showing $800 cost per client for public liability and your acceptable cost is $600, you know you're probably not profitable even if the real number is $700 instead of $800.

Work with the data you can get. Build better tracking over time. But don't wait for perfect data before you start making strategic decisions about where to invest your marketing budget.

Pro Tip: Work backwards from your unit economics: case value minus operating costs = profit. At a 5:1 CAC:LTV target, you can spend up to 20% of your profit per case on acquisition.

What This Means for Your Marketing Budget Right Now

The Australian personal injury market has lower acquisition costs than US benchmarks suggest. But the range is massive depending on platform, case type, tracking methodology, and most importantly, case value.

Best-case paid social campaigns with clean tracking: $250-$515 per client. Google Ads campaigns in competitive markets: $1,000-$3,000+ per client. Maybe more if you're going after highly competitive terms in Sydney or Melbourne.

Neither of those numbers is inherently good or bad. A $3,000 cost per client is fantastic if those clients are worth $80,000 in fees. A $300 cost per client is terrible if those clients are worth $4,000 in fees and cost $3,500 to service.

Stop optimising for lowest cost per client. Start optimising for highest profit per dollar spent on marketing.

That means knowing your unit economics by case type. It means segmenting your marketing so you can track which channels deliver which case types. It means calculating acceptable cost per client based on case value and operating costs, not based on what feels expensive or cheap.

And it means understanding that higher-cost channels like Google Ads often deliver higher-value cases. The cost per client looks scary compared to social advertising, but the CAC:LTV ratio might be better because you're acquiring clients worth 5x to 10x more.

The firms winning in personal injury marketing right now aren't the ones with the lowest cost per lead. They're the ones who understand which clients are actually profitable to acquire and what they can afford to pay for them.

Figure out your acceptable cost per client by case type. Build tracking that's good enough to make informed decisions. Then spend aggressively on the channels delivering profitable clients regardless of what the cost per client number looks like in isolation.

That's how you actually scale personal injury marketing profitably.

Pro Tip: The firms winning in PI marketing aren't chasing the lowest cost per client - they're identifying which clients are profitable to acquire and spending aggressively to get them.

Want us to implement these strategies for you?

Book a free strategy call and let's discuss how we can grow your business.

Book Your Free Call

Written by

Byron Trzeciak

Founder of PixelRush, Byron has spent over a decade mastering digital marketing. His agency has helped 300+ brands grow, managed $10M+ in ad spend, and optimised 400+ landing pages. He shares hard-won strategies so you can skip the learning curve.

Continue Reading

View All →

Why Personal Injury Google Ads Are Getting More Expensive (And What to Do About It)

22 min read